Bitcoin (BTC) Short-Term Holders: Will They Defend $55,000?

[ad_1]

An accelerating bull market usually correlates with an increasing influx of new investors. Short-term holders of Bitcoin (STH) – as the on-chain analysis calls them – join the market during the booming bull market. Driven by the desire for a quick profit, they don’t hold assets for long.

However, if Bitcoin price corrects, as in the case of last week’s price action, short-term holders quickly lose ground. Despite this, their behavior and presence in the market are crucial to maintaining a healthy bull market.

What Is the Significance of Bitcoin Short-Term Holders?

Observing the behavior of Bitcoin short-term holders is important because of historical correlations to the BTC price. The STH category includes addresses that hold their BTC for less than 155 days. After crossing this arbitrary limit, addresses become long-term hodlers (LTHs). They hold assets for the long term and are not inclined to sell emotionally.

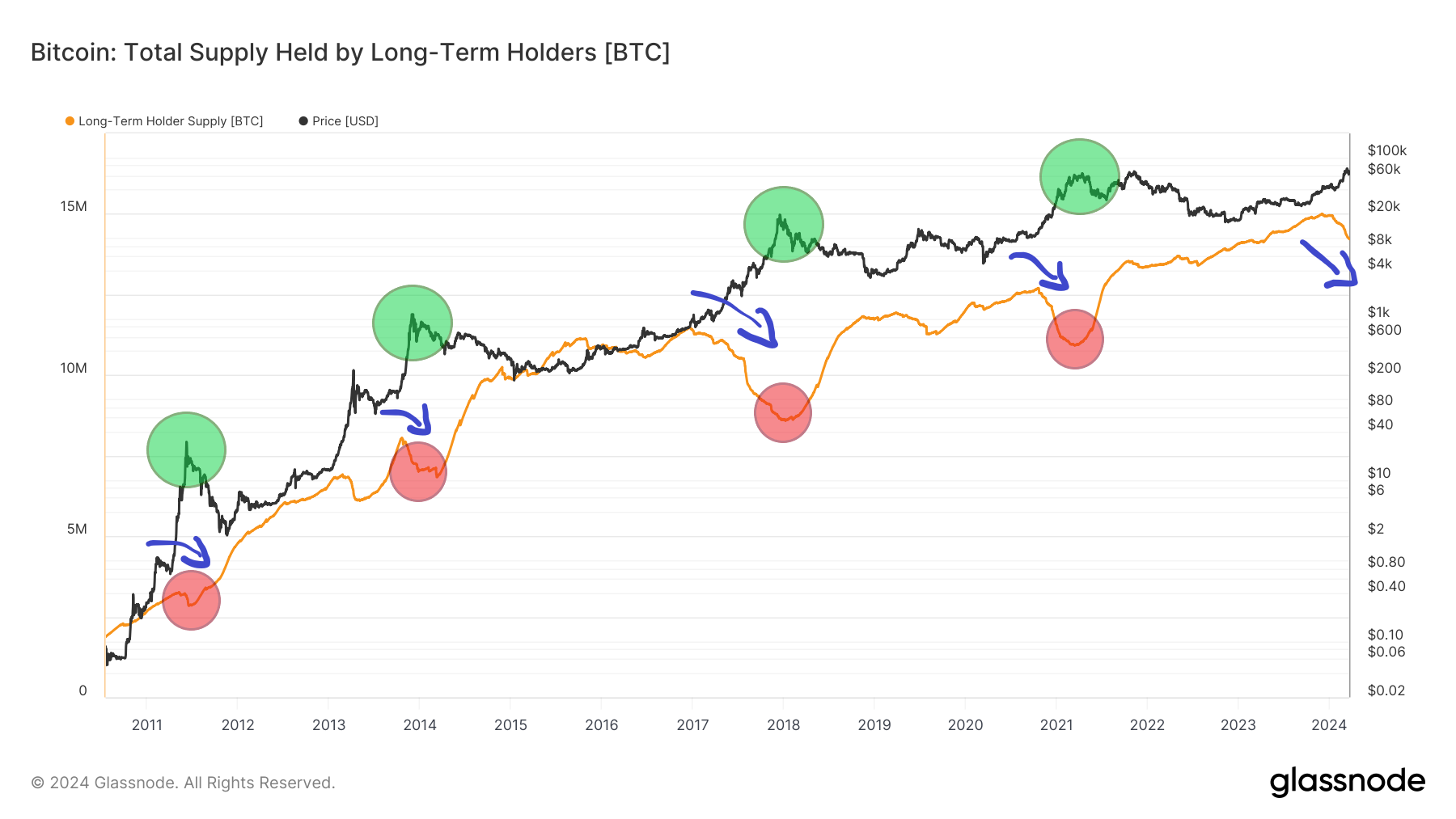

Naturally, the increase in the percentage of BTC supply held by STHs is inversely proportional to the percentage in the hands of LTHs. Interestingly, the long-term chart of supply in the hands of LTH is also inversely proportional to the price of Bitcoin. This is especially evident during the peaks of successive cycles. The more Bitcoin is sold by long-term holders (red areas), the higher the BTC price is (green areas).

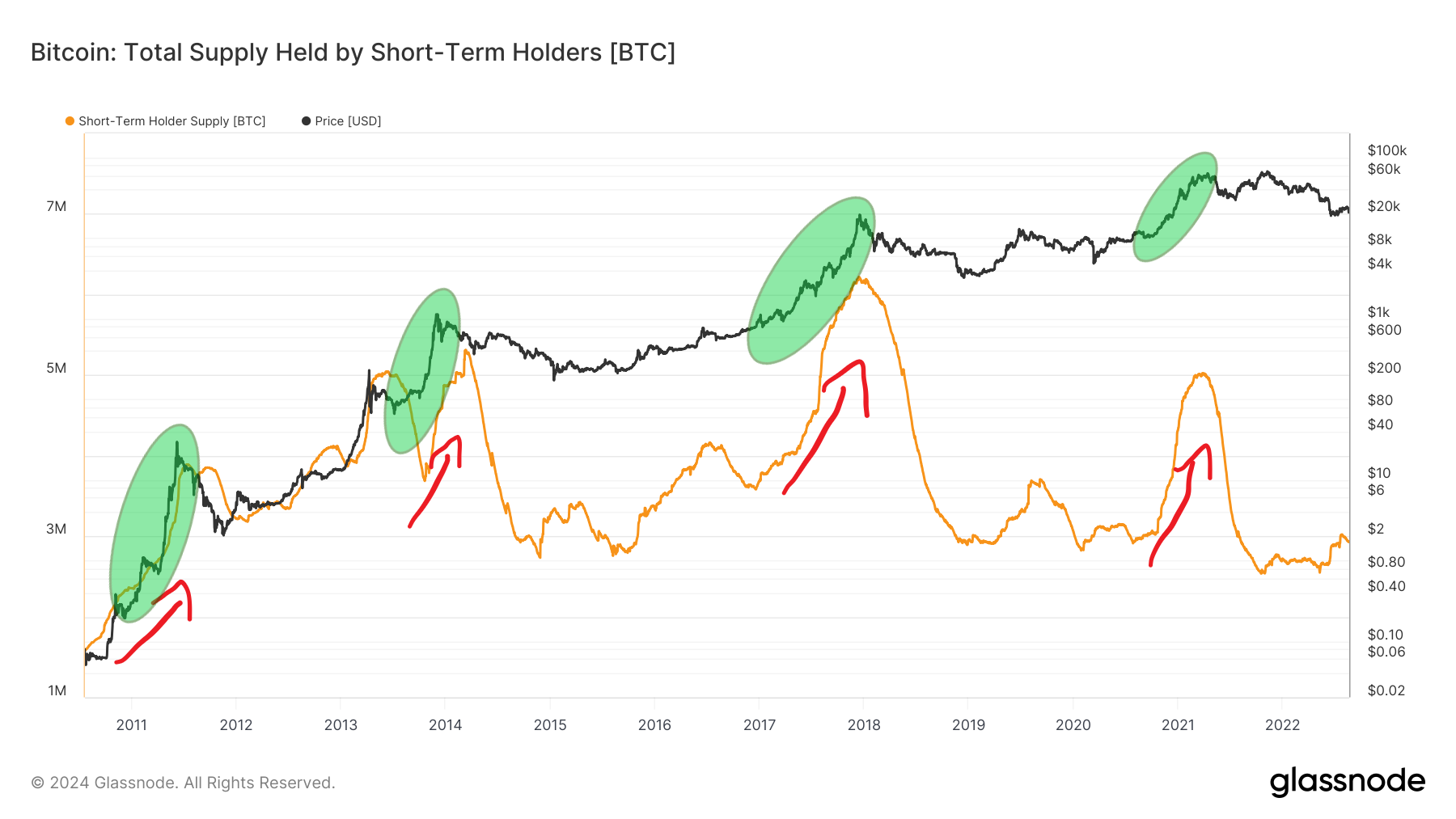

Therefore, the supply in the hands of STH is usually directly proportional to the price of BTC. New, inexperienced market participants buy BTC during increases (red arrows).

They are convinced that since the cryptocurrency has already surged, it will continue to do so (green areas). This fuels a growing circle of new investors and traders who still want to join the momentum of the bull market. Hence the importance of following what short-term holders are doing on-chain.

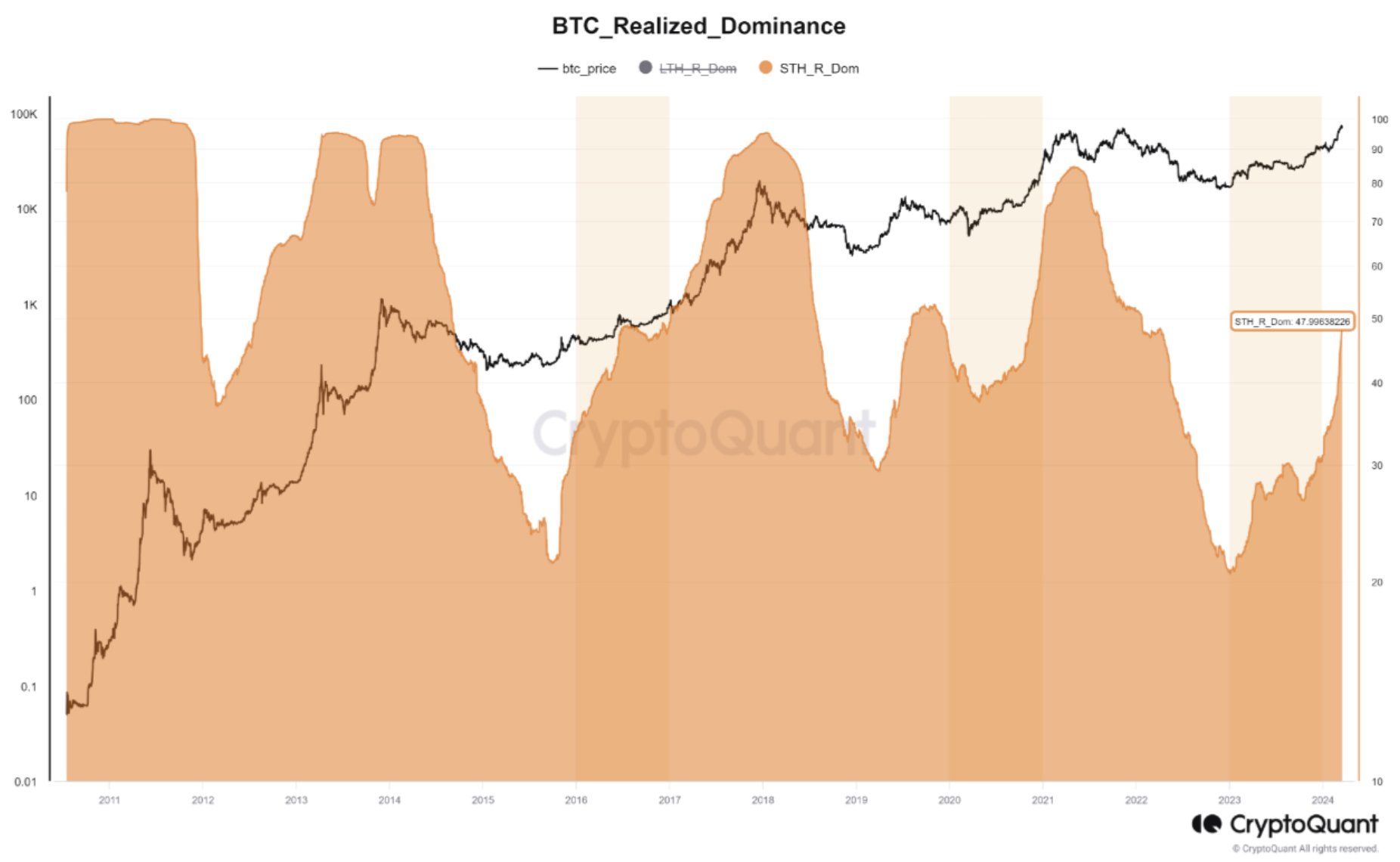

Short-Term Holders Account for Nearly 50% of BTC Realized Cap

In a recent article, analyst company CryptoQuant pointed out that nearly 50% of Bitcoin’s realized capitalization is in the hands of short-term holders. A particular increase in this indicator can be seen over the past 30 days when the enthusiasm and pace of STH purchases have surged.

“This occurrence, alongside indicating a very high bullish sentiment among short-term holders, reflects a higher dominance of this capital amount in the market over the coming weeks and months.” – the on-chain analysts added.

However, on the other hand, another CryptoQuant analyst wrote that the pace of selling LTH-held assets does not yet suggest a late phase of the cycle. In other words, there is still a lot of potential in the current cycle for buying by STH and an increase in the price of BTC.

“However, we have not yet seen entry into this late stage of the cycle, although sporadic corrections are common, in part due to the highly leveraged nature of the current market,” he stated.

Key Support at $55,000

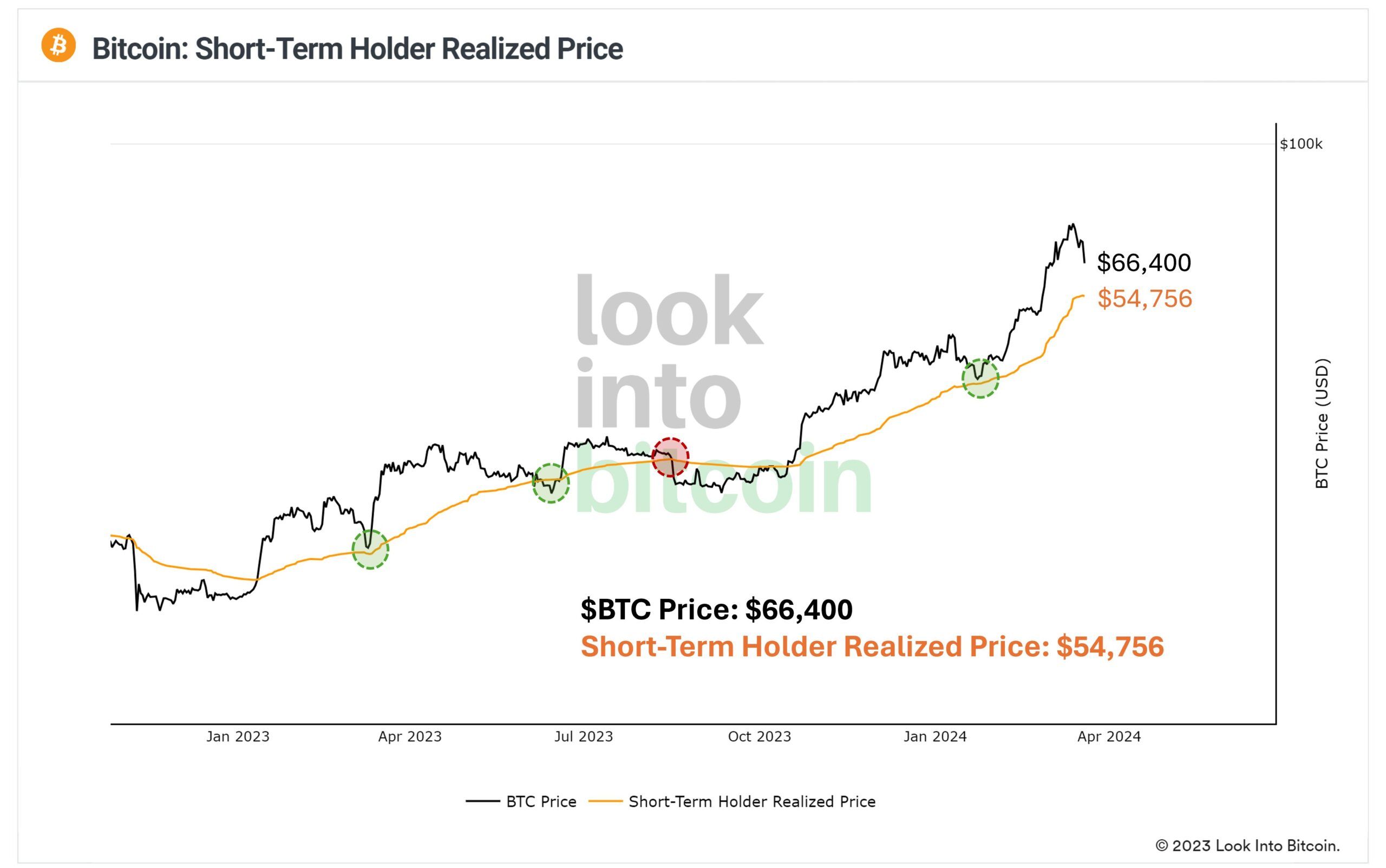

Finally, well-known cryptocurrency market analyst @PositiveCrypto published his perspective on STH’s behavior on X today. He presented a chart of the realized price of short-term holders.

He stressed that in the ongoing bull market, the curve has already provided support for the Bitcoin price three times (green areas). At the same time, he emphasized that one time the value of BTC dropped below this support, which resulted in a deeper correction in the market.

The analyst then predicts that if Bitcoin’s ongoing correction were to again lead to the area of the realized STH price, Bitcoin would reach the area of $55,000. Measured from the current all-time high (ATH) of $73,777, this would be a drop of about 25%.

However, even such a deep correction would not disrupt the structure of the long-term bull market. Only the loss of this support and deeper declines could trigger a medium-term bear market, which could dominate the vicinity of the upcoming halving.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link