3 Signs That Will Tell You When Bitcoin Is About to Top

[ad_1]

Discerning the optimal moment to exit the cryptocurrency market is as crucial as the decision to invest. Dennis Liu, also known as Virtual Bacon, shared a methodical and strategic approach to navigating the peaks and troughs of Bitcoin.

He proposed a three-pronged exit plan, each element designed to signal when the market may have reached its top.

1. Price Targets: The First Harbinger

The initial sign to consider is the attainment of specific price targets: $200,000 for Bitcoin and $15,000 for Ethereum. Liu suggested that reaching these figures could indicate the market is at its peak.

This criterion is grounded in historical market cycles and diminishing returns. It is a clear, quantifiable indicator that removes the guesswork from the decision to exit, emphasizing the need for setting realistic and informed benchmarks.

2. Time Constraint: The Second Signal

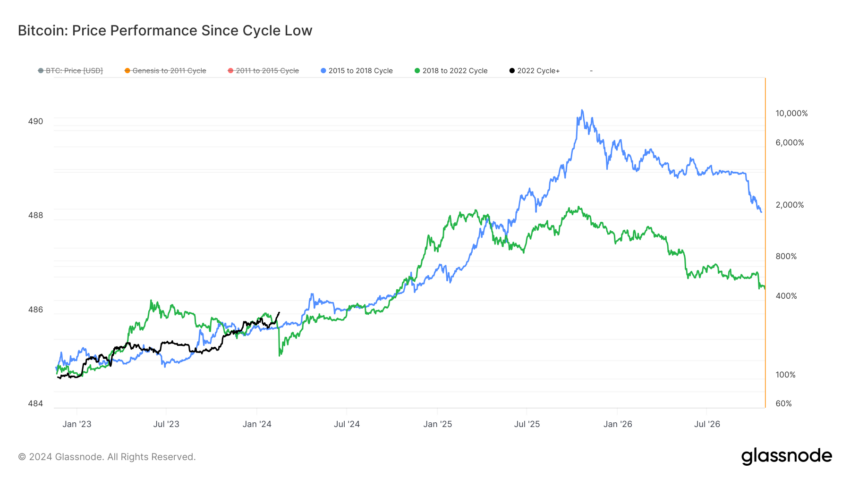

Another pillar of Liu’s strategy is time-based. Regardless of market performance, he plans to exit by the end of 2025. This decision stems from an analysis of Bitcoin’s halving cycles and the historical duration of bull markets.

By setting a temporal boundary, Liu introduces a disciplined approach to investment, encouraging investors to avoid the pitfalls of overextension. This time-bound exit strategy relies on the importance of historical patterns in predicting future market behavior.

3. Price Patterns: The Third Indicator

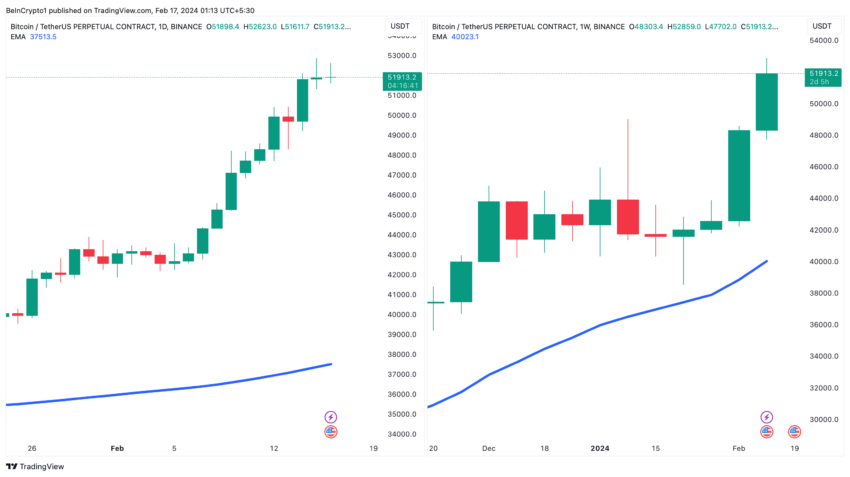

The final aspect of Liu’s plan involves closely monitoring price patterns, specifically the behavior of Bitcoin in relation to its 200-day and 21-week Exponential Moving Averages (EMAs). A break below these support levels would trigger an exit, indicating a potential downturn.

This approach relies on technical analysis, demonstrating the need for a nuanced understanding of market indicators and their implications for investment strategies.

“This is my exit plan. If any of the three conditions are met, make a full exit, and never look back,” Liu concluded.

Read more: Bitcoin Price Prediction 2024/2025/2030

Dennis Liu’s exit strategy offers a comprehensive guide for navigating the volatile cryptocurrency market. By integrating price targets, time constraints, and price patterns, Liu provided a trustworthy roadmap for investors. Adhering to such well-founded strategies could be the key to maximizing returns while mitigating risks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link